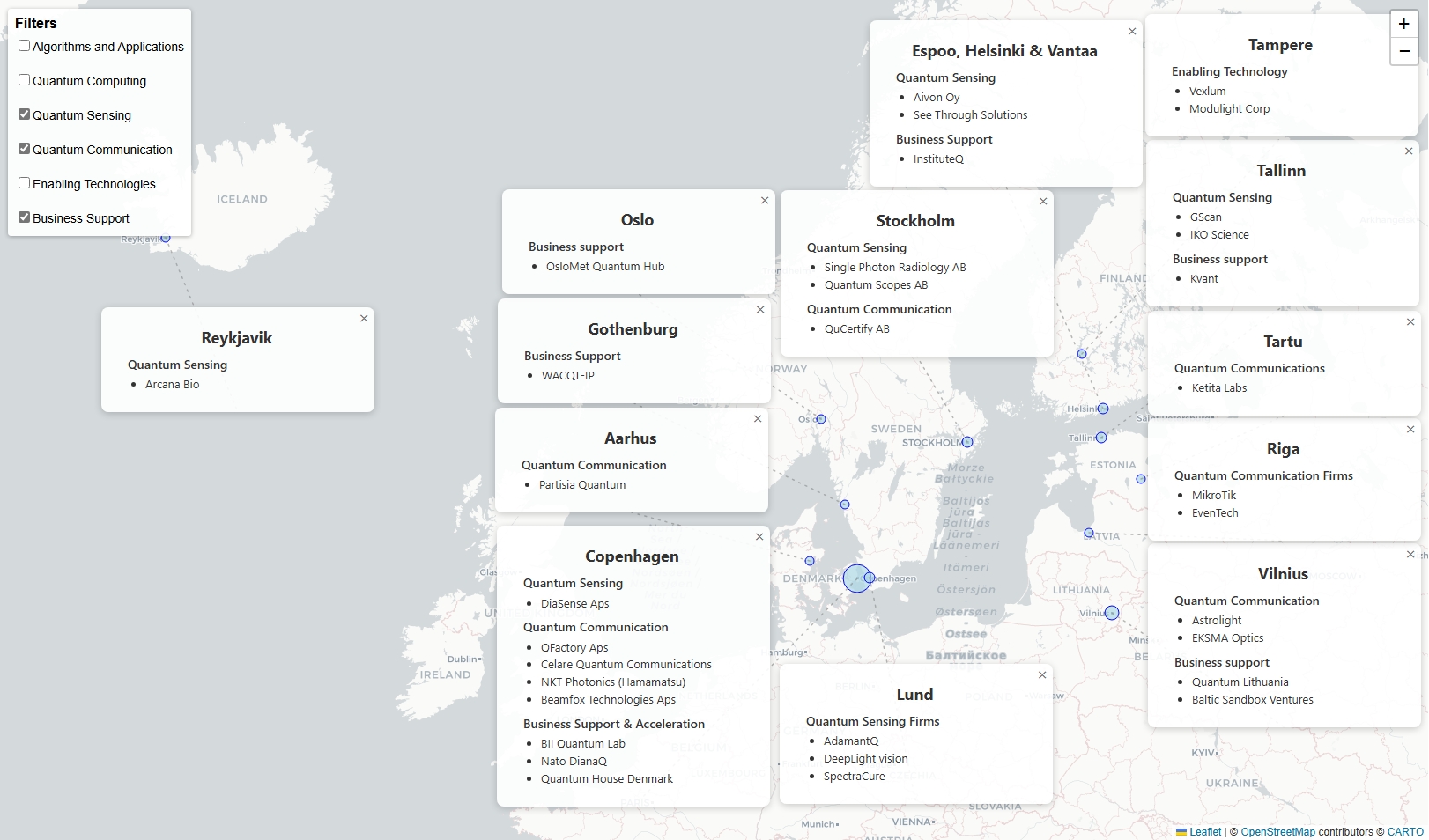

Mapping of Nordic-Baltic quantum business ecosystems

The Nordic–Baltic quantum technologies business ecosystem map provides a clear, at-a-glance overview of the region’s rapidly evolving quantum sector. By visualizing the whole constellation of quantum technology "makers" [1][2] — from pioneering startups and established technology firms — this map makes it easy to identify existing clusters, emerging hubs, and potential points of collaboration across Denmark, Finland, Iceland, Norway, Sweden, Estonia, Latvia, and Lithuania.

Understanding the geographic distribution of these key players is essential for policymakers, investors, and corporate strategists alike. It highlights strengths to build on and gaps to address, guides targeted partnership development, and supports informed decision-making in a field where proximity and network effects are critical. This ecosystem map, therefore, serves as both a strategic planning tool and a catalyst for deeper Nordic–Baltic cooperation in quantum innovation.

Quantum computing

Hardware excellence fueling broader innovation and global reach

Across the Nordic-Baltic region, three principal hardware hubs drive quantum computing development: the Copenhagen area, Espoo in Greater Helsinki, and Gothenburg. Each hub is anchored by leading universities and public research institutes, which remain the region’s primary sources of foundational innovation.

Quantum computing HW & SW firms and enabling technologies

The patent landscape (see figure below) reflects both these deep academic roots and growing industrial ambition. IQM leads with a large portfolio focused on superconducting and planar qubit architectures. Global telecom giants Ericsson (with 23 patents) and Nokia (with 7 patents) follow closely, staking early claims in quantum-enabled communications and error-correction methods. However, how actively they participate in the Nordic-Baltic ecosystem remains unclear beyond their broader operations.

Quantum computing patents (Nordic and Baltic countries)

The figure includes patent holders with three or more patent families. In addition, there are 2 patent families by WACQT IP AB, EpinovaTech AB, Artic Instruments, Molecular Quantum Solutions APS, Aarhus University, Microsoft Technology Licensing LLC, QET Sweden AB, QDevil APS, and Quanscient Oy. Also, 33 single patent-family holders exist, which are not displayed in the figure.

Public research organizations also contribute critical patents that seed later spin-out companies. For example, the University of Copenhagen and VTT Technical Research Centre of Finland bridge theoretical advances in quantum control with practical demonstrators, ensuring that Scandinavian academic excellence continues feeding into commercial pipelines.

On the software and algorithms front, the ecosystem is less mature but rapidly evolving. Fast-growing firms like Algorithmiq, specializing in quantum-accelerated chemistry simulations, already hold multiple patent families, signaling a clear IP strategy for niche leadership. Other quantum software players such as Denmark’s Kvantify and Finland’s Quanscient and QMill have also secured multi-million-euro funding rounds, demonstrating rising market interest.

Beyond core qubit technologies and applications, a flourishing ecosystem of enabling hardware and control-software developers, including areas outside the main hubs, is taking shape. Over thirty additional entities hold single patent families, ranging from specialist labs to emerging startups. This long tail covers innovations from photonic-qubit components to novel error-mitigation protocols. The fact that many small teams or individual inventors own one or two patent families highlights a vibrant grassroots ecosystem of experimentation that complements the work of larger players.

Taken together, this distribution of patent activity demonstrates a maturing Nordic-Baltic quantum ecosystem. Leading organizations build depth and scale, while agile newcomers explore high-value niches. Academic institutions continue to seed the field with breakthrough ideas and strategic alliances—whether through licensing or joint ventures—and promise to convert these patents into the next generation of quantum hardware, software, and services.

Quantum sensing

An emerging frontier with untapped industrial potential

Quantum sensing is a rapidly evolving field that promises transformative improvements in measurement precision, particularly in biomedical imaging, navigation, materials characterization, and defense. However, current patenting activity in the Nordic-Baltic region suggests the field is still in a nascent phase commercially. Only 46 patent families related to quantum sensing have been identified in the region, with a handful of organizations — IQM, Nokia, VTT, and Algorithmiq — holding more than one patent family. This modest IP footprint, however, does not reflect the broader industrial potential embedded in the region.

Quantum sensing, communication and business support

Several Nordic institutions and companies have longstanding industrial and research experience in classical sensing domains that are highly relevant to quantum applications. Finland's VTT stands out with its decades-long work in superconducting quantum interference devices (SQUIDs), which it also manufactures commercially. These superconducting sensors form a foundational technology for many quantum sensing applications, especially in areas like biomagnetism and magnetoencephalography (MEG).

Beyond this, the Nordic region hosts a broad base of companies specializing in classical sensing, low-noise electronics, optics, and photonics, all providing essential enabling technologies for future quantum sensors. Despite this alignment, many of these firms have not moved strategically into quantum sensing. Significant investment in research, retooling, and market development is required to transition existing expertise toward quantum-enabled products — efforts that currently remain largely invisible in public IP filings or commercial announcements.

Quantum sensing patents (Nordic and Baltic countries)

Note. Figure excludes 17 patent family holders with only one patent family.

Meanwhile, a new generation of startups is beginning to emerge, many building on academic advances in Sweden and Denmark. Notably, sensing nodes within the Wallenberg Centre for Quantum Technology (WACQT) in Lund and the Center for Biomedical Quantum Sensing in Copenhagen are spawning ventures focused on developing commercially viable quantum sensors. These startups are targeting applications in healthcare, neuroscience, and precision navigation, aiming to bring quantum-enabled products to market within the next few years. However, their commercial footprint is still at an early stage and not yet strongly reflected in IP portfolios or major venture capital activity.

While the Nordic-Baltic region has a strong foundational ecosystem in measurement and sensing, the leap into quantum sensing will require concerted policy, funding, and industrial engagement to capitalize on existing strengths fully. The region stands at a promising inflection point, with a visible research-to-commercialization pipeline beginning to take shape.

Quantum communication

A nascent but strategically positioned field

Quantum communication in the Nordic-Baltic region remains in an early commercialization phase, particularly when benchmarked against global frontrunners. Patent data illustrates this clearly: across seven countries, only 58 patent families have been identified in the field of quantum communication—a small figure given the strategic importance of secure communication in the quantum era.

A handful of players currently dominate commercial and research patenting activity. The top three patent holders are Nokia Technologies Oy (19 patent families), Telefon AB LM Ericsson (11), and Nokia Solutions & Networks Oy (5), together accounting for nearly two-thirds of all regional patents. These figures reflect strong Finnish and Swedish industrial foundations in telecommunications, particularly in classical network infrastructure, which are now being extended into quantum-secure applications.

Quantum communication patents (Nordic and Baltic countries)[3]

Note. Figure excludes 14 patent family holders with only one patent family.

Startups and SMEs focused exclusively on quantum networking or novel photonic quantum communication platforms are still rare and invisible in the patent survey. However, there appear to be emerging startup activities in some of the key quantum hubs in the Nordics. Denmark emerges as the leading country in the number of firms primarily focusing on quantum communications[1]. Much of the activity in Denmark and the Nordic-Baltic region is linked to the European EuroQCI initiative, which aims to establish cross-border quantum key distribution links between key national nodes. This includes government-backed efforts to secure digital infrastructure and strengthen sovereignty in critical communications.

In summary, the Nordic-Baltic region has essential technological capabilities and research depth in quantum communication but lags in commercial maturity and patent output compared to global leaders. With focused investments, clearer national strategies, and stronger industry-academia partnerships, the region could begin translating its latent strengths into a competitive quantum communication ecosystem.

[1] Data excludes companies that are categorised as end-users, consultants or educators. Although research organisation are highly important for competitiveness, they are excluded in this study, since they are evaluated in complementary study of quantum research in Nordics.

[2]Categorising companies exclusively under "quantum computing", "quantum sensing" and “quantum communication” is challenging due to overlapping technologies; the same hardware and software innovation may support use cases in different quantum technologies. Each company is listed only once (to avoid overcrowding the figure), based on an estimation what is the most relevant category for the company.

[3] Post-Quantum Cryptography is an active research area across the region, but it was not included in the patent analysis, as PQC solutions, while highly relevant to securing data against future quantum threats, do not involve quantum physical phenomena directly.